The World's Next Oil Magnate

Last night, one read that while Donald J. Trump wanted to control Venezuela's oil industry, he hadn’t considered — of course he hadn’t — how the Venezuelan oil industry could operate profitably under his control:

Despite Trump's optimism, oil companies have appeared skeptical of quickly entering, expanding or investing in Venezuela. A history of state asset seizures, the ongoing U.S. sanctions and the latest political instability all feed into this caution.

Trump said he believed that tapping Venezuela's oil reserves is "going to reduce oil prices."

Gas prices are already at multiyear lows. The average retail gas price on Monday was $2.81, according to AAA. That's the lowest since March 2021.

"Having a Venezuela that’s an oil producer is good for the United States because it keeps the price of oil down," Trump also added.

While lower oil prices could make gas cheaper at the pump, it would likely also mean lower revenues for the same big oil companies that Trump is counting on to bankroll the rebuilding of Venezuela’s oil industry to the tune of billions of dollars in foreign investment.

See Kristen Welker and Steve Kopack, Trump says the U.S. government may reimburse oil companies for rebuilding Venezuela's infrastructure, NBC News, January 5, 2026.

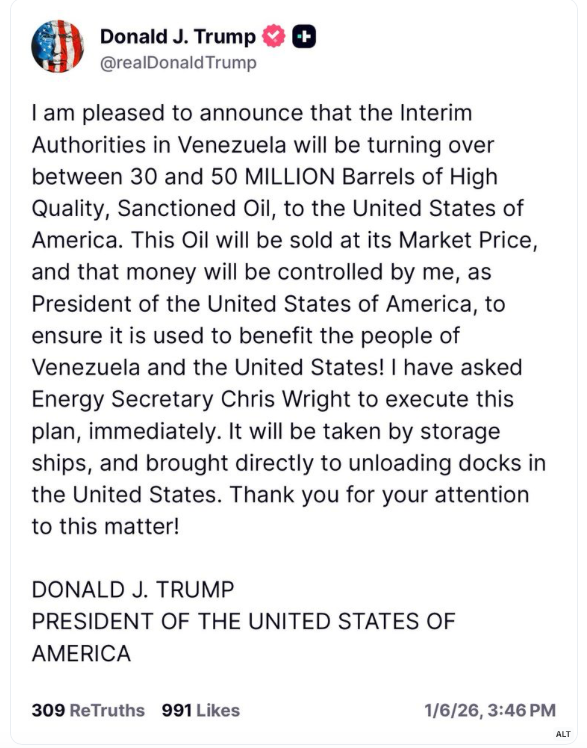

This evening, Trump has solved the problem of profitability by announcing a policy of theft for the benefit of all:

When thieves sell their stolen goods, at whatever price, it's called fencing. In Trump's case, stable genius that he is, he is his own fence, moving stolen property as he sees fit.

None of this, of course, involves true market transactions (that are by their nature voluntary for both parties).

Someone will have to write a paper addressing Coincidental Relationships Between Naval Armadas and Oil Prices.